When Gov. Mike Braun signed Senate Enrolled Act 1 into law last year, he deemed it “historic tax relief.”

The bill introduced a property tax credit of 10 percent of a homeowner’s bill, up to $300. It also changed how farmland is assessed to provide further tax relief for farmers.

In total, SEA 1 could save homeowners $1.3 billion over the next three years.

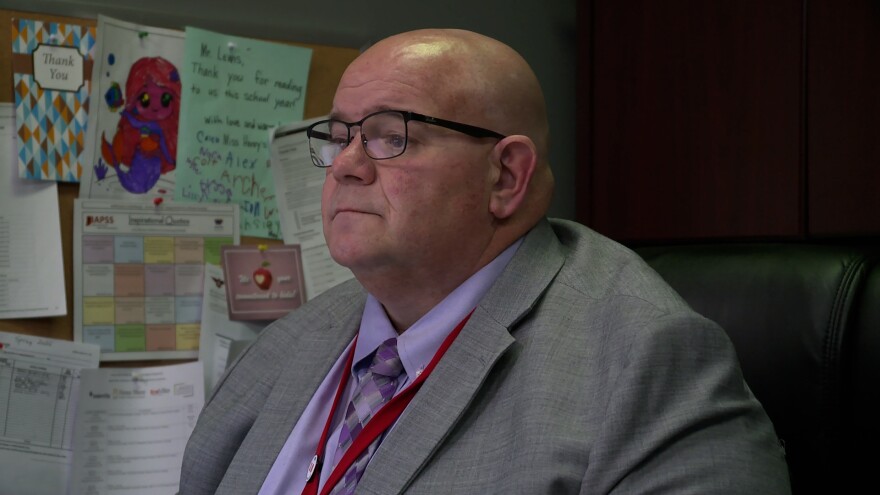

For Doug Lewis, the superintendent of Eastern Greene Schools, these cuts raise alarms.

“We were actually cut $787,000, which is approximately 20 percent of our operations budget,” he said.

Eastern Greene is a rural school district, with just 1,100 students enrolled in K-12.

And though administrators anticipated these budgetary woes and made cuts to their central office and custodial staff, they’re still looking for ways to save money, possibly by reducing the number of bus routes.

“We are a very large district in square miles, so we can only reduce those routes so much and not put a kid on the bus for 90 minutes one way, that's just not feasible for families and for the kids,” said Lewis.

In Indiana, the state education fund covers teachers’ salaries and benefits, while local property taxes go into a school’s operational budget, which literally helps keep the lights on Utility bills, equipment maintenance, insurance, transportation, and security are paid for with property taxes.

“I'm a taxpayer in this district, so, it will reduce my taxes,” Lewis said. “But at what cost? I've got to keep a school open. I mean, public school is something that's fundamental in our society. We need to have that for our students.”

Eastern Greene isn’t alone. Schools all over the state are feeling the belt tighten, though rural districts with a smaller tax base are more likely to see larger cuts.

And nowhere are those cuts more evident than when looking at what schools call their “circuit breaker,” otherwise known as the amount of tax dollars an entity is losing due to tax caps.

“A taxpayer who owns a home may actually owe $2,000 in taxes…but due to circuit breaker, they can only legally pay $1,500,” said Brian Harmon, a school budget consultant who has worked with over 30 school districts in Indiana.

At Eastern Greene, the circuit breaker is projected to increase from $242,000 in 2025 to $1.2 million in 2026.

Story continues below.

See how much your school district is projected to lose over the next three years with this tool from the Indiana Coalition for Public Education.

“There are also schools that have circuit breakers that don't reach $100,000, so it varies from school district to school district depending on the makeup of that particular district,” he said. “So the effect of Senate Bill one, while we can make some generalities of what we could expect from that, it will vary, and can vary rather dramatically, from school district to school district.”

Harmon said he expects to see more referendums across the state to make up for this shortfall.

“I think that will be an outlet or an avenue the school districts may have to try to use,” he said. “Now, you can't count on that, because, again, it's a referendum. It's got to be approved by the community. They've got to see the value in that.”

Schools aren’t the only ones feeling the crunch. Jim Higgins, a partner with LWG CPA and Advisors, said local income taxes are also changing, meaning municipalities lose property tax as well as income tax money.

“You're going to take two hits,” he said. “And the question is, how do we function? Right? How do we continue to pay for the services that people want to have? Sixty percent of most local government budgets are police and fire.”

In some cases, these changes may amount to a tax increase if local governments raise income taxes to offset the loss of property tax revenue.

“If I'm an apartment renter, my landlord's getting property tax relief,” he said. “I'm not sure that transfers into a lower rent,” he said. “But my income tax may be higher because my income tax isn't different depending on whether I'm in a home or not.”

Higgins said the good news is that the full impact won’t happen for a few years, meaning there’s time to tweak taxes in upcoming legislative sessions.

“They're talking about the implementation of the income tax and whether or not that gets delayed,” he said. “And so they may, depending on what the bodies do, delay that for a year or two, so that they could work out or make changes to how the income tax is distributed.”

And while many will appreciate seeing more money in their accounts, others like superintendent Lewis believe it shouldn’t come at such a steep cost.

“I don't think these were intended results, not completely, but I do think that they wanted us to tighten up our belts, and this was one way to do it,” he said. “But I think there's more to it than what they anticipated.”

Though many legislative leaders said tweaking SEA 1 would be a priority this shortened session, no bills on the verge of passing will do so.